DUBAI, United Arab Emirates (AP) — Long-haul carrier Emirates signaled Tuesday it will hold off on a major purchase of Airbus A350 aircraft over concerns about their Rolls Royce engines, marking a major blow for the European manufacturer as it hopes to close the sale during the Dubai Air Show this week.

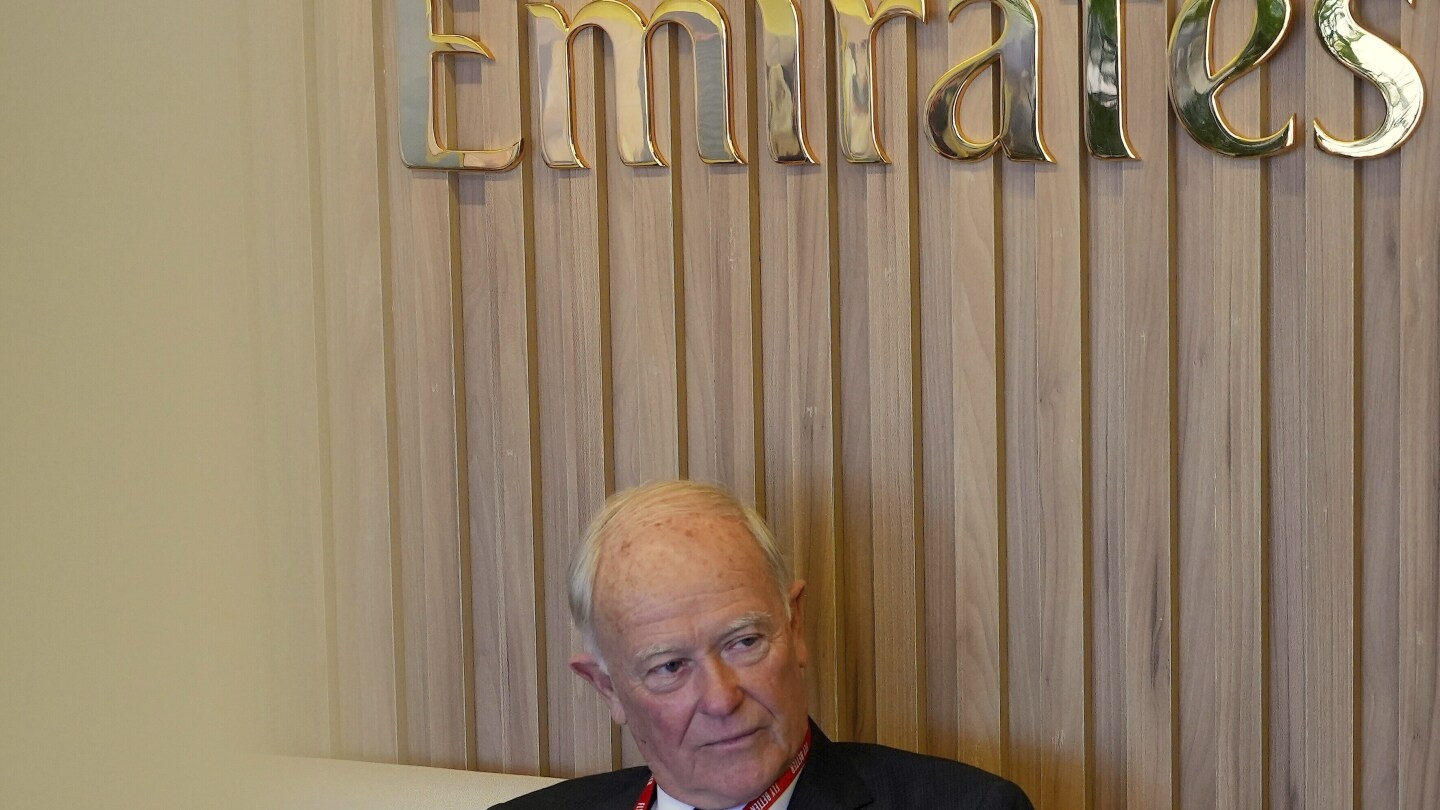

Emirates President Tim Clark’s comments to journalists at the show came the day after his airline announced a $52 billion purchase with Airbus’ rival Boeing Co., while its sister airline FlyDubai bought another $11 billion of aircraft from Boeing.

Meanwhile, Ethiopian Airlines said it was buying 31 aircraft from Boeing, including 20 737 MAX aircraft in a sign of renewed confidence in the single-aisle aircraft by the carrier after it suffered a deadly crash in 2019 with the airplane that led to its worldwide grounding.

Airbus has yet to strike a major deal at the show, which comes as global airlines like Emirates have bounced back from the lockdowns of the coronavirus pandemic with increased global demand for travel.

In his comments to journalists at the Emirates chalet on the runway of Al Maktoum International Airport, Clark raised concerns about the maintenance required for the Rolls Royce engines on the A350.

“If the engine was doing what we want it to do … then it would re-enter the mix of assessment for our fleet plan,” Clark said.

Airbus and Rolls Royce did not immediately respond to a request for comment by The Associated Press.

Emirates is a heavyweight when it comes to East-West travel out of Dubai International Airport, the world’s busiest for international travel.

Clark also said that Emirates needs to buy aircraft now as it moves forward with plans to expand its routes and networks.

“Irrespective of the difficulties of getting these aircraft out of the door, we have to place orders now because the lead time for deliveries are so long,” Clark said.

Clark also said that the tensions in the wider Middle East sparked by the Israel-Hamas war in the Gaza Strip wouldn’t affect Emirates’ business, adding they are used to working around the region’s geopolitical problems. He said although the Israeli market was one of the fastest growing markets for Emirates, they had to stop their daily flights to Tel Aviv, Israel, but that the airline was able to absorb the demand fall-off.

Emirates and FlyDubai launched direct flights to Ben Gurion International Airport in Tel Aviv after the two countries established diplomatic ties in 2020.

Two major Israeli firms — Rafael Advanced Defense Systems Ltd. and Israel Aerospace Industries had been slated to participate in the Dubai Air Show. But the IAI stand, bearing the slogan “Where Courage Meets Technology,” was roped off and empty Monday. On Tuesday, a few people gathered there.

Also in the market for aircraft is Riyadh Air, a new Saudi carrier being created as part of trillions of dollars worth of spending planned in the kingdom. In March, the airline announced an order of up to 72 Boeing 787-9 Dreamliner jetliners and has further plans to expand.

Clark said he wasn’t worried about the competition, however.

“If Saudi Arabia wants to spend $2 trillion on doing wonderful things over there, they’ve got to have the labor from somewhere. And that labor force has got to be brought in, and their carriers are going to find it difficult in the early stages to meet that demand,” he said. “So do I think it’s a problem with this lot? No, I don’t … because we managed to build Emirates through all of this competition, rising geopolitical socioeconomic difficulty.”

The air show, which sees billions of dollars worth of deals, as arms manufacturers exhibit at the show, comes two weeks before Dubai hosts the United Nations’ COP28 climate talks.

Aviation has particularly drawn the ire of climate change activists, in part due to the amount of jet fuel the industry burns. Emirates in January successfully flew a Boeing 777 on a test flight with one of its two engines entirely powered by so-called sustainable aviation fuel. Earlier this month, the airline cleared SAF for flights, including one to Sydney, Australia.

However, “decarbonizing civil aviation is incredibly difficult and will be long term,” Clark said.

On Tuesday, Ethiopian announced its deal with Boeing that will see it buy the 737 MAX aircraft, as well as 11 787 Dreamliners. It also agreed to options to potentially buy another 36 aircraft – 21 MAX planes and 15 Dreamliners. Boeing described it as “the largest-ever purchase of Boeing airplanes in African history,” without offering a sales price for the deal.

The March 2019 MAX crash shortly after takeoff from Addis Ababa killed all 157 people on board. It was the second involving a Boeing MAX in less than five months and led to a worldwide grounding of all MAX jets for nearly two years.

Asked about the crash, Ethiopian Group CEO Mesfin Tasew said it “has left a big scar in our memory.”

“We have checked and confirmed that the design defect of that aircraft has been fully corrected by Boeing and we have renewed our confidence in that aircraft,” he said.

Other purchases Tuesday included:

— Emirates announced $1.2 billion in deals with French firm Safran, including for seats.

— Emirates announced plans for a $950 million maintenance facility at Al Maktoum International Airport, the city-state’s second airfield.

— EgyptAir announced it would buy 10 Airbus A350-900s. It did not disclose the price of the aircraft.

— Boeing and SCAT Airlines of Kazakhstan announced the airline would purchase seven Boeing 737 MAX aircraft. It also did not disclose terms for the sale.