HONG KONG (AP) — Asian stocks were down Tuesday after a mixed finish on Wall Street, where the Dow Jones Industrial Average climbed to an all-time high while Big Tech companies pulled the S&P 500 and the Nasdaq composite lower.

U.S. futures fell. Oil prices eased from their recent highs, which had been driven by heavy fire between Israel and Hezbollah on Sunday.

China’s industrial profits jumped 4.1% in July compared to the previous year, with overall profits for the first seven months increasing 3.6%, bringing hopes to the market amid sluggish domestic demand, a housing downturn and employment worries.

But additional tariffs on China are clouding its manufacturing prospects. Canada announced a 100% tariff on the import of Chinese electric vehicles and a 25% tariff on Chinese steel and aluminum on Monday, with the measures set to take effect on Oct. 1. This will apply to all EVs shipped from China, many of which are Tesla cars produced in the country.

The automaker company’s U.S.-listed shares fell 3.2% Monday.

Hong Kong’s Hang Seng shed 0.2% to 17,760.40 and the Shanghai Composite index dropped 0.3% to 2,846.19.

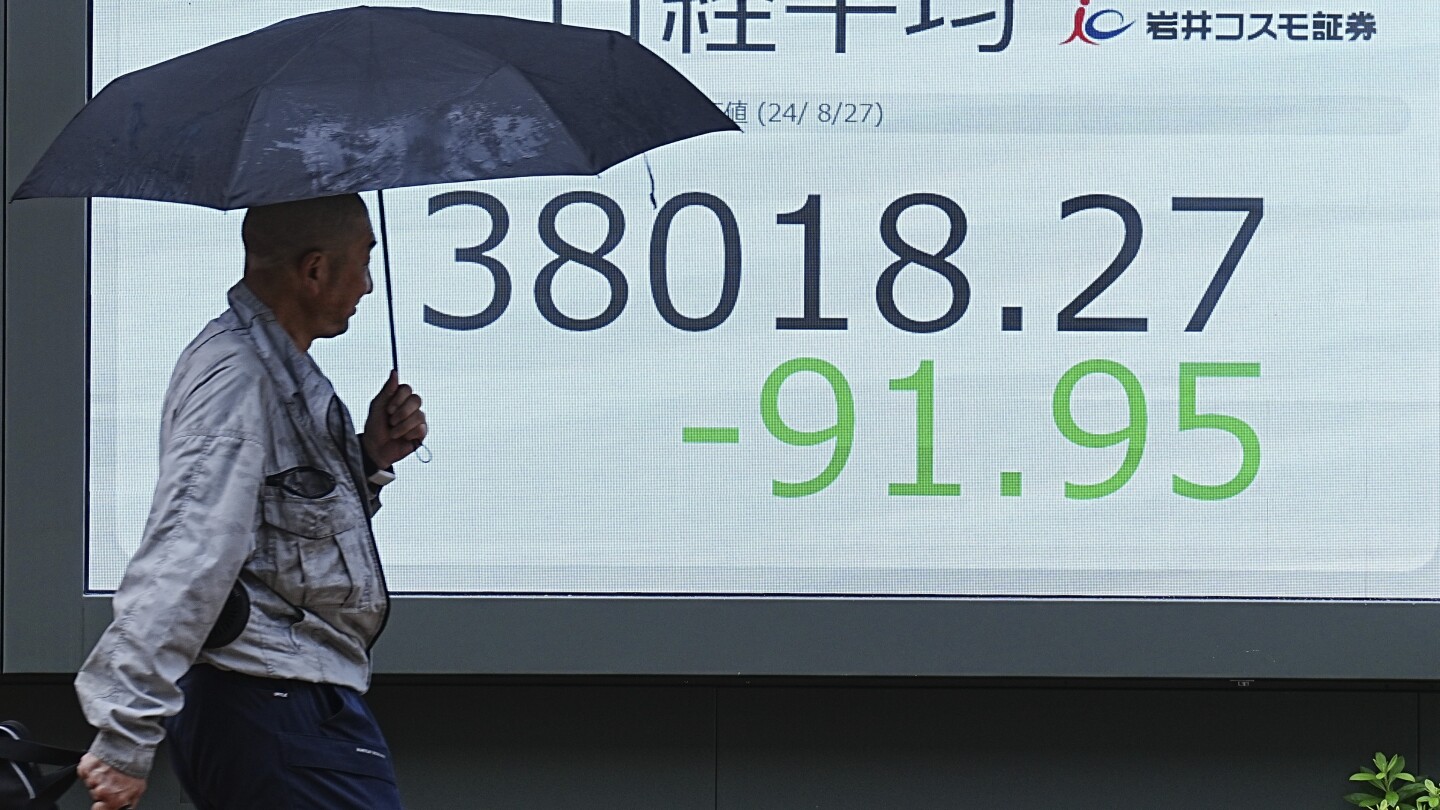

Japan’s benchmark Nikkei 225 edged down 0.1% in morning trading to 38,055.62. Australia’s S&P/ASX 200 dipped 0.1% to 8,077.50. South Korea’s Kospi dropped 0.4% to 2,687.43.

The S&P 500 fell 0.3% Monday, remaining within 0.9% of its record set in July. The Nasdaq composite fell 0.9%, pulled down by several technology companies that tend to tip the market because of their big values. Nvidia lost 2.2%, Microsoft fell 0.8%, Amazon dropped 0.9%, Meta Platforms slid 1.3% and Tesla lost 3.2%.

The Dow rose 0.2%, to 41,240, eclipsing its previous high set in mid-July. The average is less influenced by Big Tech, with only Apple and Microsoft among the most valuable “Magnificent Seven” stocks in the index. That helped limit the impact of the Big Tech decliners.

Bond yields held relatively steady. The yield on the 10-year Treasury rose to 3.82% from 3.80% late Friday.

The stock market is coming off a two-week winning streak that’s helped keep the S&P 500 and Dow within striking distance of notching new highs. Monday’s mixed market finish came at the start of a week featuring another full slate of corporate earnings and the government’s latest inflation reading.

A surprisingly good report showed that orders for long-lasting goods from U.S. factories, including cars, jumped 9.9% in July. An update on consumer confidence is on tap for Tuesday and the U.S. will provide a revised estimate on Thursday of economic growth during the second quarter.

Semiconductor company Nvidia reports its latest financial results on Wednesday. It has been a big beneficiary of Wall Street’s mania around artificial intelligence, becoming one of the stock market’s most massive companies, with a total value topping $3 trillion. The stock is up more than 155% for the year.

Shares in other chipmakers also fell. Broadcom lost 4.1%, Advanced Micro Devices dropped 3.2% and Lam Research slid 3.4%.

All told, the S&P 500 fell 17.77 points to 5,616.84. The Dow rose 65.44 points to 41,240.52, and the Nasdaq dropped 152.03 points to close at 17,725.76.

Others companies reporting quarterly results this week include Kohl’s, Chewy, Salesforce and Dollar General.

The key report for investors this week will come on Friday, when the the government serves up its latest data on inflation with the PCE, or personal consumption and expenditures report, for July. It is the Federal Reserve’s preferred measure of inflation.

In energy trading, benchmark U.S. crude fell 30 cents to $77.12 a barrel. Brent crude, the international standard, gave up 25 cents to $80.11 a barrel.

In currency trading, the U.S. dollar rose to 144.91 Japanese yen from 144.52 yen. The euro cost $1.1166, up from $1.1161.