FRANKFURT, Germany (AP) — With its economy struggling, Germany now is wrestling to find a way out of a budget crisis after a court struck down billions in funding for clean energy projects and help for companies and consumers facing high utility bills because of Russia’s war in Ukraine.

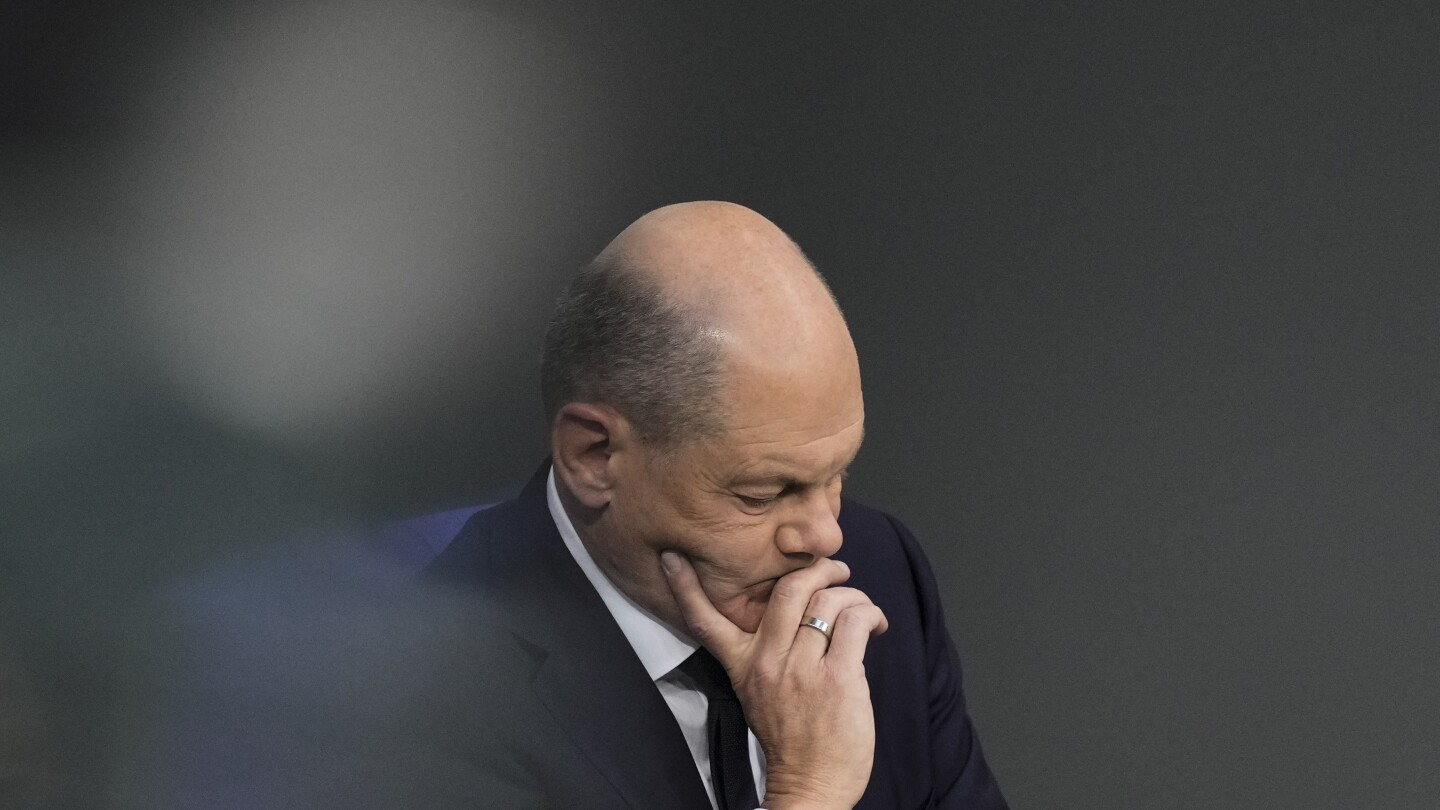

Chancellor Olaf Scholz plans to lay out how he and his quarrelsome governing coalition aim to fix things in a speech to parliament Tuesday. The government must hastily find cuts in the almost-finished spending plan for next year, analysts say, which could further slow what is already the world’s worst-performing major economy.

A long-term solution, however, could take years, possibly until after the next national elections scheduled for 2025. That’s because the strict legal limits on borrowing cited in the Nov. 15 court decision are enshrined in the country’s constitution, and a two-thirds majority in parliament is required to soften them.

Economists say spending cuts will only add to the challenges facing Europe’s largest economy after Russia cut off the cheap natural gas that fueled its factories, squeezing businesses and raising the cost of living for households paying more for energy.

“We’ve voluntarily tied our hands behind our backs, and we’re going into a boxing match,” Vice Chancellor Robert Habeck said Friday, saying the debt rules were from a time when peace reigned and climate change wasn’t taken seriously.

Alluding to massive government investment in green technology by the U.S. and China, he added, “The others have horseshoes in their gloves, and we don’t even have our hands free. It’s clear how that will end.”

Germany’s constitutional court has voided some 60 billion euros ($65 billion) in spending for this year and next. It said the government could not shift unused funding meant for COVID-19 relief to boost wind and solar projects, help with energy bills and encourage investment in computer chip production.

The constitution limits deficits to 0.35% of economic output, though the government can go beyond that if there’s an emergency it didn’t create, such as the pandemic.

The ruling also could apply to other national and local spending based on the same now-rejected accounting maneuver, covering as much as 130 billion euros in expected spending through 2027.

Some of the disallowed spending has already been used this year. To comply with the ruling, the government is changing the 2023 budget by declaring an emergency, citing Russia’s cutoff of natural gas supplies and higher energy prices.

Without yet another emergency declaration next year, the government would have to scramble to cover shortfalls of roughly 30 billion to 40 billion euros — plus 20 billion to 30 billion euros for 2025 — compared with earlier plans, according to Holger Schmieding, chief economist at Berenberg bank.

Some spending can be moved to public-private partnerships or taken over by the country’s development bank. But those fudges will only go so far. Ultimately, spending may be reduced by as much as 0.5% of annual economic output for the next two budget years, Schmieding said.

The debt limits were enacted in 2009 after the government piled up debt paying to rebuild former East Germany after Germany reunified at the end of the Cold War and when tax revenue dropped during the 2007-2009 global financial crisis and Great Recession.

For years afterward, Germany balanced its budget or even ran small surpluses as the economy lived large on cheap Russian natural gas and booming exports of luxury cars and industrial machinery, with rapidly growing China serving as a major market. Economists say the government skimped on investment in infrastructure, renewable energy and digitalization — gaps it is now trying to make up.

The fallout has left Germany projected to be the worst-performing major economy this year, shrinking by 0.5%, according to the International Monetary Fund.

Prospects for next year are only a little better. Industry is struggling with energy prices and a lack of skilled labor, while Chinese automakers are challenging Germany’s Volkswagen, BMW and Mercedes-Benz and have plans to expand sales across Europe.

The budget debate is ironic because Germany has the smallest long-term debt pile of any of the Group of Seven advanced democracies, with debt of 66% of gross domestic product. That compares to 102% in Britain, 121% in the U.S., 144% in Italy and 260% in Japan.

The now-banned spending was aimed at some of the long-term problems plaguing economic growth, such as the need to invest in new sources of affordable renewable energy like wind, solar and hydrogen. That has led to calls from some to loosen the debt limits because they restrict the government’s response to new challenges.

But Scholz’s coalition of Social Democrats, Greens and pro-business Free Democrats doesn’t have the two-thirds majority to do that without the conservative opposition, the Christian Democrats, who brought the legal challenge in the first place.

Yet even some opposition state governors have said the debt limits should be loosened. Berlin Mayor Kai Wegener, a member of the Christian Democrats, said the provision was “a brake on the future.”